Tesla’s “Transition” from Car Maker to Cash-Burner Meets Trump’s Unlikely Lifeline

In a performance that blended the tragedy of a balance sheet with the farce of political theater, Elon Musk took to the virtual stage this week to explain why Tesla’s profits have plunged 46%, why it’s scrapping its flagship models, and why it needs to burn an additional $20 billion this year. The pièce de résistance? A surprise endorsement from President Donald Trump, his on-again, off-again, on-again feud partner, proving that in Washington and Wall Street, there are no permanent enemies—only permanent interests.

The Numbers: A Vanishing Act

Let’s start with the cold, hard reality that Musk spent two hours trying to vaporize with talk of robot butlers and autonomous futures.

· Annual Profit: Fell to $3.8 billion, a 46% nosedive from 2024.

· Fourth Quarter Net Income: Plummeted 61% year-over-year.

· Annual Revenue: $94.8 billion, marking the company’s first-ever yearly decline.

· Car Sales: 1.65 million vehicles sold in 2025, down for the second straight year and enough to lose the title of world’s top EV maker to China’s BYD.

The Musk Reality Distortion Field: From “Car Company” to “Physical AI Company”

Faced with these figures, a normal CEO might discuss turnaround plans for the core business. Elon Musk is not a normal CEO. His strategy? Declare that the core business is passé.

On the earnings call, Musk announced the end of the road for the Model S and Model X, the luxury vehicles that once defined Tesla’s innovation. Their factory space will now build the Optimus humanoid robot, which Musk promised (with his trademark reliability on timelines) would launch production this year.

The new star is the steering-wheel-free Cybercab robotaxi. Musk predicted Tesla would eventually make “far more Cybercabs than all of our other vehicles combined”. This is a bold vision, given that the robotaxi service is currently in a small pilot program in two cities, a far cry from his 2025 projection of serving half of America.

The cash to fund this sci-fi pivot? A staggering $20 billion in planned capital expenditures for 2026, more than double last year’s spend. When your car sales are falling, the solution is obviously to spend unprecedented amounts of money on things that don’t yet exist.

The Political Theater: A Bromance of Convenience

No analysis of Tesla’s predicament is complete without the Donald Trump subplot—a soap opera of loyalty, betrayal, and subsidy threats.

· The Feud: After Musk left his short-lived role heading Trump’s “Department of Government Efficiency” (DOGE), he publicly eviscerated the President’s key budget bill as a “disgusting abomination”. Trump retaliated by threatening to use the DOGE to scrutinize “more subsidy than any human being in history” given to Musk’s companies. Musk fired back with an accusation that Trump was in the Epstein files. Trump declared their relationship “over”.

· The “Support”: Yet, as Tesla’s stock tanked after the dismal earnings, a miraculous Truth Social post appeared. “I want Elon, and all businesses within our Country, to THRIVE,” Trump wrote, claiming he had no intention of destroying Musk’s companies. This lifeline, however, cannot undo the policy reality of the Trump administration: the elimination of the $7,500 EV tax credit and the rollback of regulations that provided Tesla with lucrative revenue from selling environmental credits to other automakers.

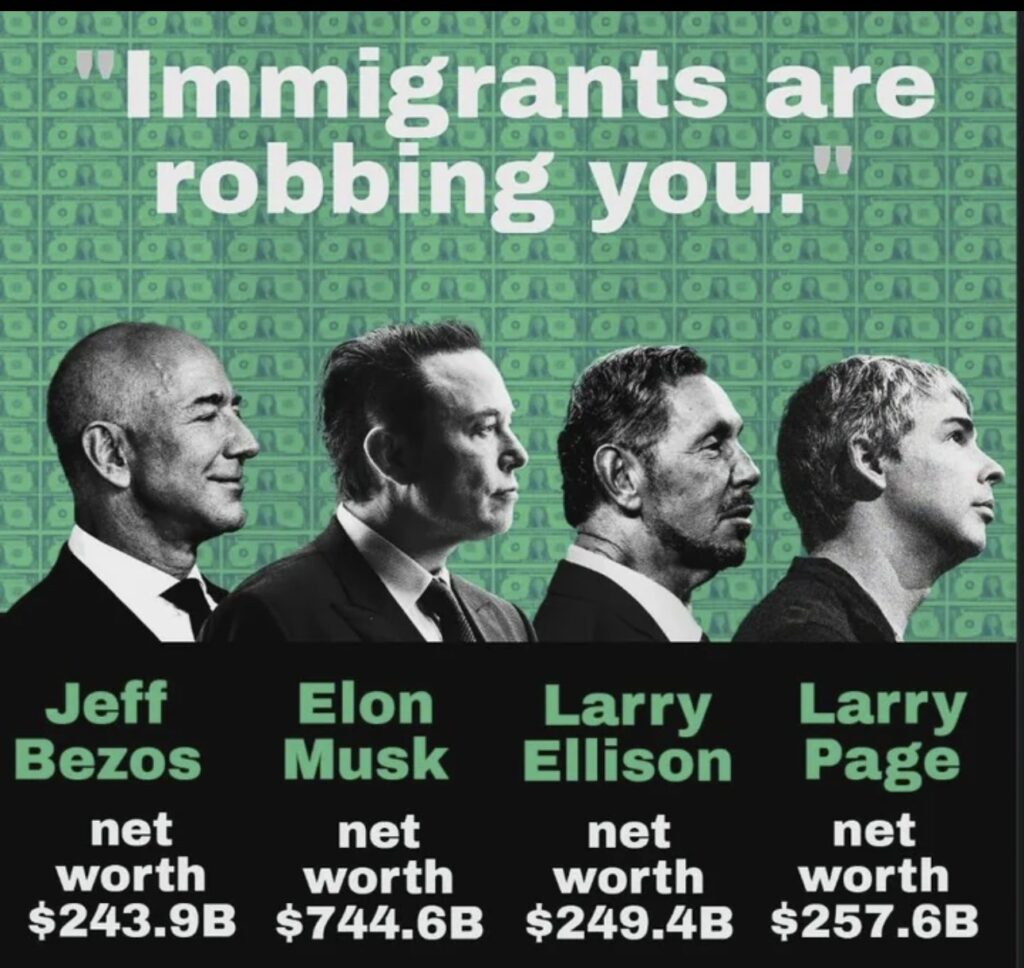

The Political Whiplash Effect on Tesla

· Alienated Base: Musk’s right-wing political activities have alienated many left-of-center buyers.

· Unconvinced New Audience: Polls show Republicans and conservatives remain less likely to buy EVs.

· Net Result: Tesla now has the worst reputation of any major car brand, with more haters than fans among the U.S. public.

The Emperor’s New Roadmap

So, what are investors and the public left with? A compelling narrative built on the ashes of underperformance.

- The Pivot: Don’t look at the declining car sales. Look at the glorious AI future. The company is even investing $2 billion into Musk’s other AI startup, xAI.

- The Blame Shift: The “rough quarters” ahead are not due to competition or brand damage, but a “weird transition period” and the loss of government incentives.

- The Promise: Just wait until “the second half of next year” when autonomy at scale will make Tesla’s economics “very compelling”. The fact that Musk has a documented history of overpromising on timelines is, apparently, a minor detail.

In the end, the earnings call was a perfect microcosm of modern Musk: a dazzling display of futuristic promises used to wallpaper over present-day cracks, all set against the backdrop of a political circus of his own making. President Trump may have thrown him a verbal lifeline, but the market, consumers, and relentless Chinese competition are less easily swayed by a tweet. Tesla is no longer a growth story; it’s a $20 billion gamble that the future will arrive before the cash runs out.