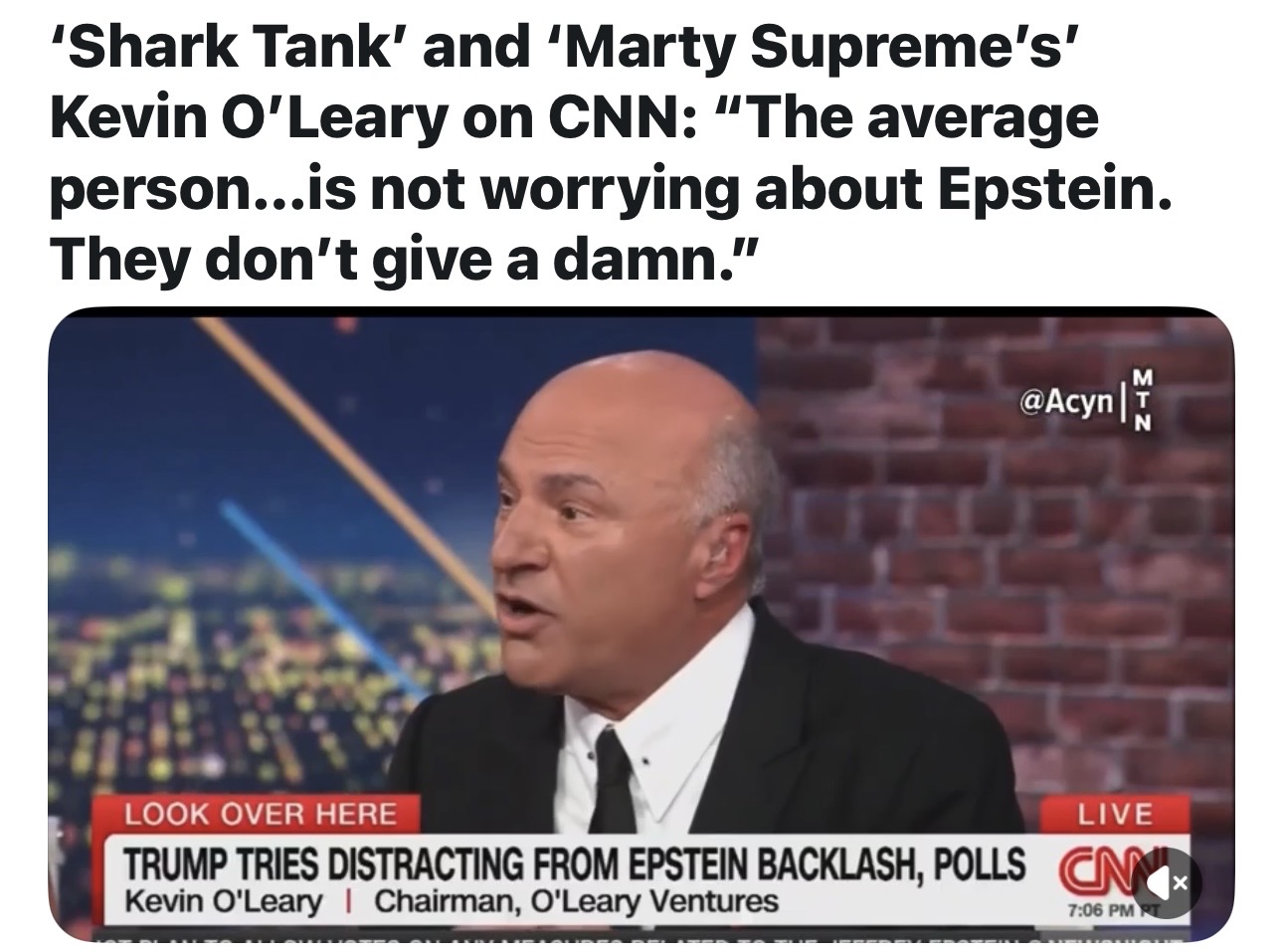

In the high-stakes arena of public scandal, few possess the ruthless pragmatism of “Shark Tank” investor Kevin O’Leary. While most people see the sprawling Jeffrey Epstein sex trafficking case as a horrifying criminal conspiracy and a profound moral failure, Mr. Wonderful has expertly reframed it as a simple matter of portfolio management. Why focus on the sordid details of abused minors when you can talk about jobs reports? In a recent, heated CNN panel, O’Leary dismissed the intense public and legal focus on Epstein as “poop on a stick” and declared that “nobody gives a damn about Epstein ’cause he’s still dead!”.

Let’s break down the O’Leary methodology. It’s not about justice; it’s about resource allocation. Here’s his apparent investment thesis for navigating elite scandal networks.

- The Core Asset: The “Dead Guy”

Every portfolio needs a stable, non-performing asset. In the Epstein fund, this is Epstein himself. As O’Leary succinctly put it, “He’s still dead”. A dead principal financier of a child sex trafficking ring generates no new liability, pays no legal fees, and is unlikely to cause further market volatility. He is, in O’Leary’s cold calculus, a closed position. The fact that his death in federal custody was ruled a suicide, albeit with widespread skepticism and unexplained gaps in video evidence, only solidifies his status as a terminal asset.

- The Contained Liability: The “Prisoner”

For a balanced portfolio, you pair a dead asset with a contained, living one. This is Ghislaine Maxwell, currently serving a 20-year sentence. O’Leary summarized the entire saga as: “There’s a prisoner, and there’s a dead guy. That’s the truth”. A convicted accomplice, safely behind bars, represents a quantified, amortized liability. Discussions about her potential pardon by President Trump—an old friend of both Epstein and Maxwell—are just noise that distracts from core economic indicators.

- The High-Value, Diversified Holdings: The Client Network

This is where a savvy investor sees untapped potential. The recently released “Epstein files”—over 3 million pages from the DOJ—aren’t a map of alleged complicity but a rolodex of high-net-worth individuals. The list is diversified across sectors:

· Technology & Business: Elon Musk (who emailed about visiting Epstein’s island), Richard Branson, Bill Gates, Google co-founder Sergey Brin.

· Politics: Former Presidents Donald Trump and Bill Clinton, Trump’s former adviser Steve Bannon (who strategized with Epstein on reputation rehab), and former Treasury Secretary Larry Summers (who gossiped with Epstein about Trump).

· Royalty: Britain’s former Prince Andrew.

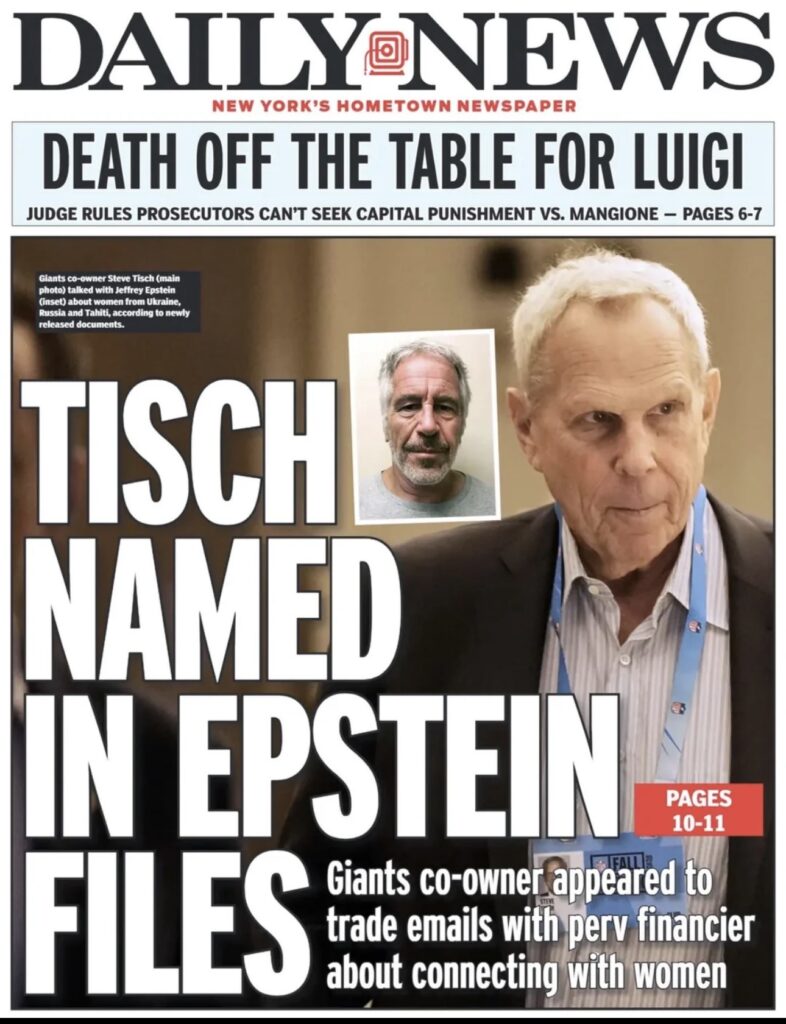

· Sports & Entertainment: New York Giants co-owner Steve Tisch.

O’Leary’s genius is in understanding that the value of this network is not diminished by association with a “dead guy.” In fact, maintaining these connections is paramount. Why pursue legal exposure when you can maintain business as usual?

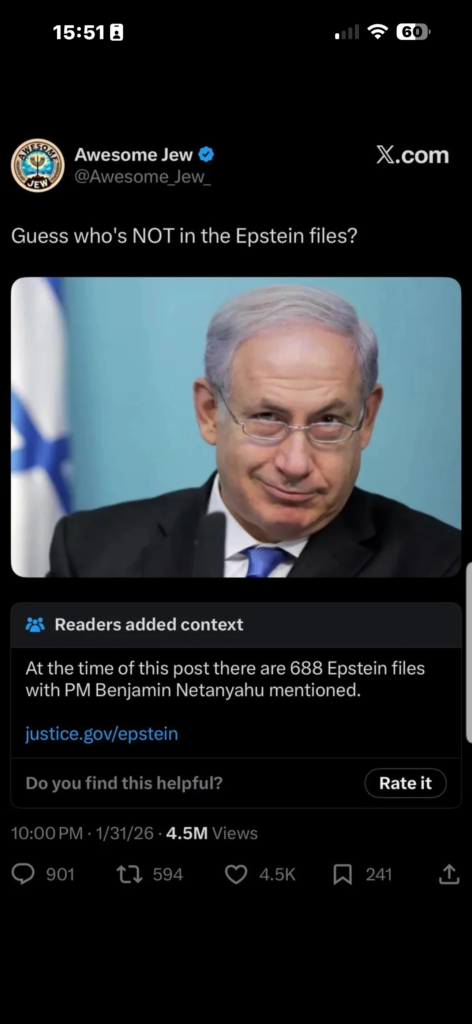

- The Strategic International Alliance: The Israeli Connection

A truly global portfolio requires international exposure. The files detail a particularly close relationship between Epstein and former Israeli Prime Minister Ehud Barak. Barak and his wife stayed at Epstein’s New York apartment multiple times, including well after Epstein’s 2008 guilty plea. An audio recording from the files even captures Barak discussing with Epstein a demographic strategy for Israel, suggesting the country needed “another million” Russian immigrants to offset other populations.

· Connection Nature: Documented personal stays and detailed geopolitical discussions.

· O’Leary’s Probable Analysis: A high-level geopolitical contact. Relationship maintained post-conviction, indicating loyalty and discretion—valuable traits in any partnership.

- The Unfortunate Nuisance: The “Victims”

In any major deal, there are transaction costs. Here, they are the victims. When challenged on CNN about speaking for them, O’Leary admitted, “I have spoken to no one! I’m just being pragmatic!”. He argued that dragging these women, now in “childbearing years,” back into the limelight was not helpful. This is classic cost-cutting: minimizing the noise from underperforming emotional assets to keep the focus on the growth potential of the main portfolio.

Conclusion: The O’Leary Exit Strategy

The final pillar of this approach is the exit. The Trump administration has stated the investigation is complete. Despite victims calling the document release a betrayal that protects enablers, and lawmakers from both parties demanding full transparency, the official stance is moving toward closure.

Kevin O’Leary is simply ahead of the curve. He has performed a ruthless cost-benefit analysis on one of the most grotesque scandals of the century and found it… unworthy of attention. For him, the only relevant numbers are on a GDP spreadsheet, not in a FBI victim affidavit. It’s not that he doesn’t understand morality; he just has a quarterly report due. And in the wonderful world of dealmaking, justice for abused children is rarely accretive to earnings.

Disclaimer: This satirical analysis is based on real public statements made by Kevin O’Leary on CNN and documented information from the released Epstein files. The portrayal of financial “portfolio management” as a metaphor for his dismissive stance is fictional commentary.